Nine Reasons You Should Take Another Look at Whole Life Insurance

Before some years, analysts believe that whole life insurance is only waste of money. And if one desire to buy, he should buy term life policy instead of whole insurance. But for now, though the policy is same, the view of getting it is changed. No doubt, they were right in their time on the basis of information they got but current financial advisers are also right. Many of us don’t have an idea how the life insurance policy works.

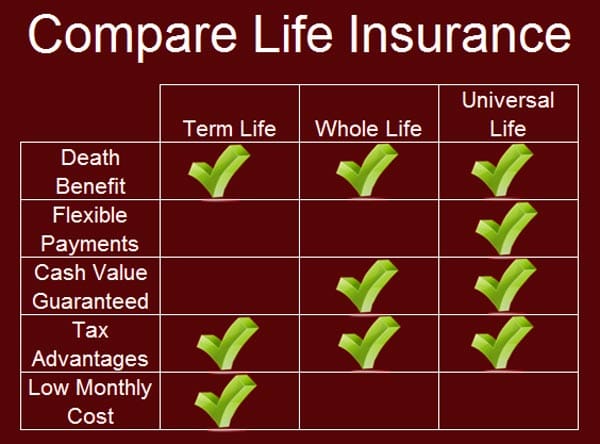

The following are advantages of whole life insurance policies:

1) Principal protection guarantees of your money

The principal amount of policy does not depend on market risk as like share market and mutual funds. Therefore, a fixed amount is received on maturity of the policy.

2) Guaranteed growth of your money every year

It depends on compound tax-free growth and interest rate driven based. Every year, the growth rate increases on the basis of policy you have chosen.

3) Dividends paid to policy owners are not taxable

Not everyone but many reputed life insurance companies paid out dividends every year. These dividends are not taxable in the hands of the policy holder.

4) A high starting cash value amount, based on what you contribute to the policy

A well-maintained life insurance policy contains high cash value in its first year and increases every year. This access money helps to grow wealth in a proper way without taking into account market risks.

5) Access to your cash value at any age, at any time, for any reason — without taxes or penalty

Comparing to 401(k) and IRAs, accessing cash before retirement is tax-free as well as penalty-free in the whole life insurance policy.

6) The ability to use your account’s cash value to recapture lost depreciation on major purchases and interest and fees paid to banks

This policy can be put as a loan to the bank for creating wealth.

7) Guaranteed insurance

Many people assume that they can buy new insurance at any stage in their life. But the chronic disease doesn’t come with an alarm. Once you secure with life insurance policy, there is no need to worry more.

8) The ability to combine your life policy with the worlds of real estate, private lending, and auto financing

This policy gives a push to wealth because the investment in it is totally tax-free.

9) Death benefits

During the life, there are benefits the person can enjoy and after his life also, his/her beneficiaries receive tax-free money.

Most Searching Terms:

- whole life insurance plans comparison

- best whole life insurance policy in USA

- whole life insurance policy pros and cons

- how does whole life insurance work as an investment

- is permanent life insurance a good investment

- the difference between whole life insurance vs term life insurance

- which is better whole life or term life insurance