Insurance is a complex field, filled with terminology and processes that can be baffling to the average person. One such term you may encounter in the insurance world is “insurance adjustment.” But what does it mean, and how does it affect you as a policyholder? In this article, we’ll demystify insurance adjustment, providing you with a clear understanding of its significance and how it impacts your insurance claims.

Unpacking the Concept of Insurance Adjustment

Before we dive into the specifics, let’s begin by unraveling the concept of insurance adjustment.

1. What Is Insurance Adjustment?

An insurance adjustment, in simple terms, is the process of assessing and settling insurance claims. It involves the evaluation of a claim to determine the extent of coverage and the amount the policyholder is entitled to receive as compensation for a covered loss or damage.

2. The Role of Insurance Adjusters

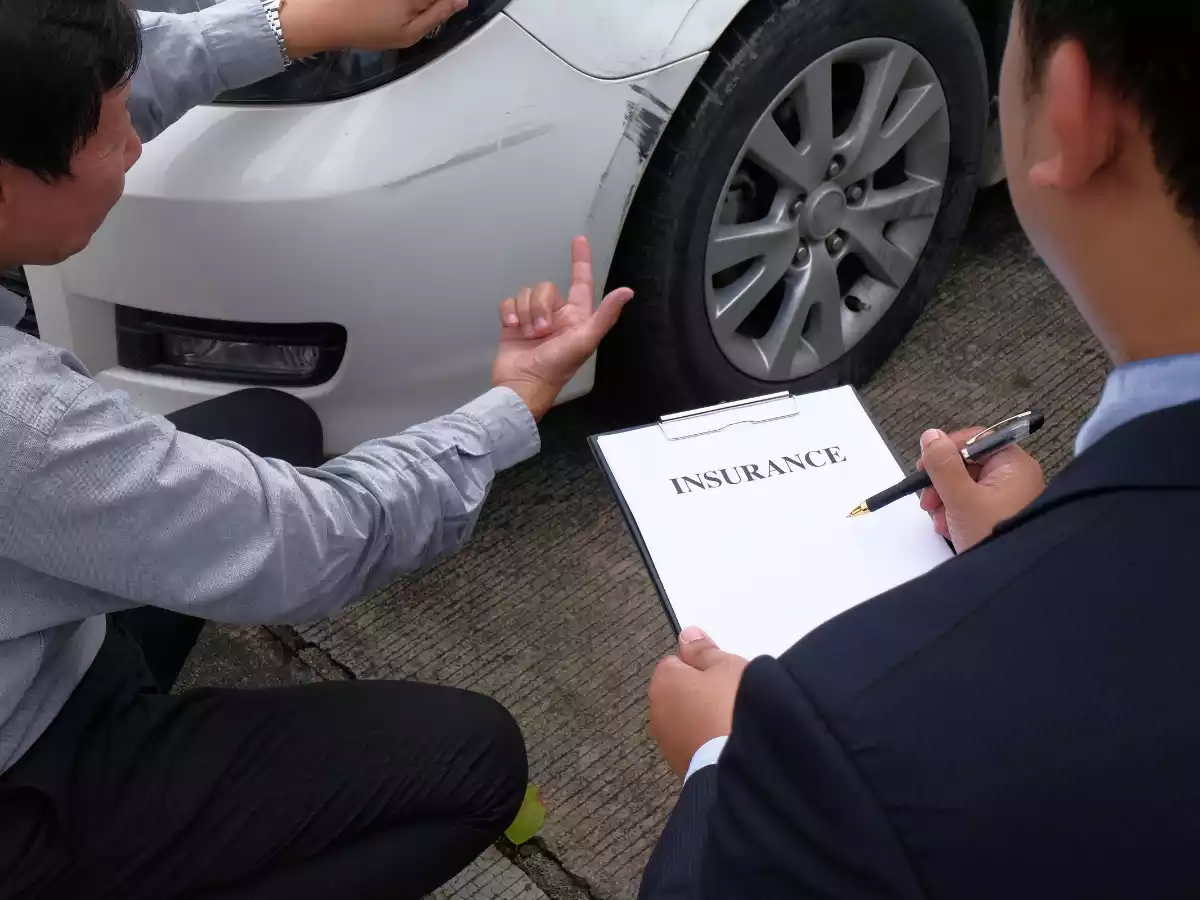

Insurance adjusters, also known as claims adjusters or claims examiners, play a pivotal role in the insurance adjustment process. They are responsible for investigating insurance claims, gathering relevant information, and determining the validity and value of the claim.

Types of Insurance Adjustment

Insurance adjustment can take several forms, depending on the type of insurance and the nature of the claim. Let’s explore a few common types:

3. Auto Insurance Adjustment

In the case of auto insurance, an insurance adjustment occurs when a policyholder files a claim for damages or losses resulting from a car accident. An adjuster evaluates the damage to the vehicle, reviews the policy terms, and calculates the compensation the policyholder should receive.

4. Home Insurance Adjustment

For homeowners, insurance adjustment comes into play when they file a claim for damage to their property, such as due to fire, theft, or natural disasters. An adjuster assesses the damage, reviews the policy, and determines the coverage and payout.

5. Health Insurance Adjustment

In health insurance, adjustment pertains to the calculation of medical expenses and the portion covered by the insurance policy. Adjusters review medical bills, treatment records, and policy terms to determine the amount the insurance company will pay, and how much the policyholder is responsible for.

The Insurance Adjustment Process

6. Filing a Claim

The insurance adjustment process typically begins when a policyholder experiences a covered loss or incident and files a claim with their insurance company.

7. Claim Investigation

An insurance adjuster is assigned to the claim and conducts an investigation. This may involve interviewing the policyholder, collecting evidence, and assessing the extent of the loss or damage.

8. Claim Evaluation

Once the investigation is complete, the adjuster evaluates the claim in accordance with the policy terms and coverage limits.

9. Settlement

The insurance company offers a settlement based on the adjuster’s findings. If the policyholder accepts the offer, they receive compensation for their loss or damage. If not, negotiations may occur.

Conclusion

In conclusion, insurance adjustment is the critical process by which insurance claims are assessed and settled. It involves the work of insurance adjusters who investigate, evaluate, and determine the compensation owed to policyholders for covered losses. Understanding this process is essential for policyholders to navigate the world of insurance claims effectively.

FAQs

- Is insurance adjustment the same as insurance underwriting?

No, insurance adjustment and underwriting are distinct processes. Insurance adjustment occurs after a claim is filed, while underwriting is the evaluation of risk and issuance of insurance policies. - Can I dispute the insurance adjuster’s decision on my claim?

Yes, if you disagree with the adjuster’s assessment, you have the right to dispute the decision and seek a resolution through negotiation or legal means. - Do I need to hire a public adjuster for my insurance claim?

It’s not mandatory, but some policyholders choose to hire public adjusters to represent their interests during the insurance adjustment process, especially for complex claims. - How long does the insurance adjustment process typically take?

The duration of the adjustment process can vary widely depending on the complexity of the claim and the cooperation of all parties involved. - Can an insurance adjuster deny my claim?

Yes, an adjuster can deny a claim if it does not meet the terms and conditions of the insurance policy. However, policyholders have the right to appeal such decisions and seek resolution.

Read more:https://wink24news.com/

More related